Yogita

Credit Analyst

Author Bio:

Yogita is an experienced corporate credit analyst. She is enthusiastic about personal finance and learning about diversified asset classes that lead to wealth-creation opportunities.

If there is one convention that thriving economies can reflect upon- it is credit. It is 2023, and the concept of credit in our financial systems could not be more significant. Traditional credit systems involve loans & credit facilities extended to corporations for smooth functioning of their operations, given no entity has sufficient funds to execute large operations at any given time. As long as banks and for- profit companies exist, the economy is more interconnected than we presume.

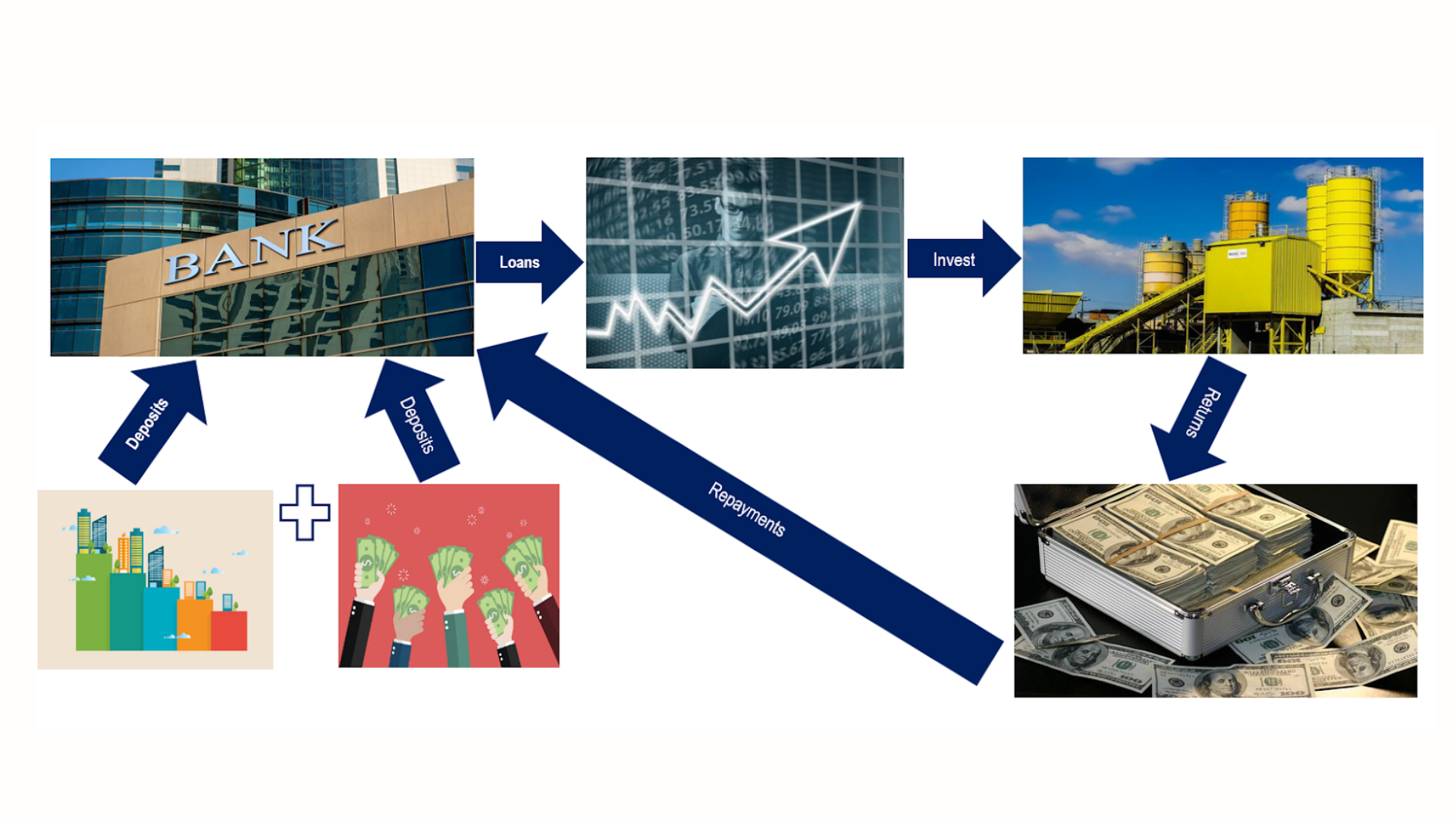

A rudimentary example of the interconnected structure of an economy is the deployment of funds deposited in banks. The funds are ultimately used by business entities to execute large scale projects, leading to creation of employment opportunities. This in turn leads to an increase in the quantum of deposits, and ultimately more money available with banks for the lending business.

Source: Pixabay

Unlike the above illustration, credit systems are very complex. The above cycle depicts individuals and institutions depositing their excess money with banks, which in turn lend to corporates for investing in growth projects. Business entities generate higher returns over a period of time, and this money is repaid, along with interest payments.

In reality, there are many layers to each stage of this process. For example, excess funds are parked with various other institutions apart from banks, such as mutual funds, equities, bonds, physical assets (like gold, real estate, art) etc. Moreover, the corporate lending business is streamlined through several institutions, including NBFCs, mortgage companies, venture capitalists etc. The above illustration also excludes the extension of credit to individuals, which is discussed below in the article.

There is a key component in the credit cycle stated above - Risk. In the above scenario, the Company borrowing the funds, has been successful in its new venture and has generated sufficient returns, to not only repay its borrowings, but also grow its profits and cash flows. This is an ideal scenario. However, we do not live in an ideal world and there could be multiple possibilities-

- Failure of the project,

- Unethical management practices

- Disruption in that particular industry, or,

- in the worst case – liquidation

Credit Control Best Practices:

If the Company goes bankrupt, or the management absconds, lending institutions will have to absorb large amounts of bad debt, which in turn will impact the depositors.

To avoid this ripple effect in the economy, stringent risk control measures are required in place. Lending decisions, in their very basic framework, ensure that at least the principal amount lent is secured.

Avoiding a credit default situation requires robust processes before making a lending decision, as set down below:

Source: Microbilt

- Credit quality analysis: For assessing the credit quality, various factors are analyzed including financial performance of the Company, nature of its business, market position, industry trends, repayment history and the borrower’s ability to sustain during a down cycle. Advanced systems developed by financial institutions assign credit ratings (quantifying the probability of default) to the prospective/ existing borrowers as a control measure.

- Determine sources of repayment: Due to the complexity of the business environment, despite a good credit quality, companies tend to default on their obligations due to unforeseen circumstances. A backup plan is required to ensure timely repayment from the borrower in such a situation. Sufficient liquidity to repay debt due at least in the next 12 months, is a primary requirement. Apart from the Company’s existing liquidity, recurring cash flow generation, access to capital markets to refinance its existing debt and underlying collateral for the loan are also important sources of repayment.

- Provide a forecast scenario: As per the above two indicators, the borrower’s repayment capacity can be determined for the current period. However, future events could lead to a change in the Company’s existing circumstances, leading to a deterioration (or improvement) in its credit quality. Events like industry disruption- a classic example being the adoption of electric vehicles disrupting the automobile industry, lifestyle changes, entry of a new competitor, a breakthrough technology etc., could lead to a potential change in the Company’s future earning capacity.

To sum it up, for the healthy functioning of an economy, it is important that credit cycles do exist. Money flowing across various institutions and ultimately individuals ensures that a large portion of the population has access to funds, and various industries and businesses benefit from lucrative opportunities. Envisage a world where money is largely static and only a few institutions/ individuals have access to an enormous amount of wealth. This scenario would be detrimental to the interests of the wider population, given it is highly unlikely that a limited number of individuals would spend their wealth on an expansive range of products and services. Broader access to credit leads to expansion of choices and thereby business opportunities.

Credit utility for individuals

Let us now briefly walk through the utility of credit for individuals. In the past decade, individuals are able to access credit effortlessly owing to the increase in alternatives and ease of processes. A major percentage of the earning population has made or is making use of EMIs, credit cards and BNPL (Buy Now Pay later) schemes. The million dollar question- Is this good or bad? Finance experts claim that credit systems were never made for those who needed credit. Billionaires never make use of debit cards. By using credit, they ensure that they do not lose the opportunity to grow their money.

Source: Pixabay

Let’s say Mr. X, a billionaire, is planning to buy a Maybach, for his daughter’s 20th birthday. It will cost him $200,000. Mr. X has billions at his disposal, therefore the $200,000 is an insignificant amount. However, he chooses to buy the Maybach on credit (at an interest rate of 4.0%). How does that make sense? Mr. X has invested his money in several businesses, therefore his money is constantly growing. Paying an upfront amount for the Maybach, will cost him the returns he could have otherwise earned (opportunity cost), had he not withdrawn the investment. Assume that his money is growing at 20% annually (average return from all his investments). Earning returns of 20.0% vs paying an interest rate of 4.0% guess who is winning here?

This is how the rich always get richer. That being the case, is it not advisable for the mid- range income earners category to use credit? Statistics suggest that the highest percentage of the population belongs to this category. For credit businesses to thrive, it is necessary that this section participates in the credit system. The answer is, it is advisable.

However, the intention behind using these facilities have to complement the strategy of Mr. X. Nevertheless, most individuals fall into the trap of using credit to fulfil otherwise unaffordable desires. Prudent financial management boils down to, return on investments being larger than the cost incurred for utilising credit.

Similar to corporate borrowings, retail credit too faces the risk of default. Therefore, utilizing these systems for effectuating unaffordable desires is not advisable. To keep credit quality checks in place, retail borrowers are assigned credit scores, a concept parallel to credit ratings assigned to business entities. Higher the credit score, superior the individuals’ credit quality.

It is imperative to build a good credit score, for acquiring future financing comfortably and at lower rates. Future financing needs arise primarily for availing home loans and education loans (for children). Use of credit cards and timely repayment thereof, leads to building higher credit scores. A further reason to avail the provision of credit systems in place.

Wrap Up:

In conclusion, corporates and individuals availing credit is a win- win for the economy as a whole. However, this is subject to good credit quality of the borrower and higher yields over a period of time for both the parties involved.