Nishtha Jain

ESG Analyst

Author Bio:

Nishtha Jain is an experienced ESG and Governance professional having worked with organizations such as CRISIL, Quantum Mutual Fund, and liAS. She is currently pursuing her MBA from S.P. Jain Management School and is part of the exchange program at INSEAD and ESB Business School.

The economic landscapes of South Korea and India, emerging from their respective historical and geopolitical contexts, present a fascinating study of contrast and resilience. Let us delve into this comparative analysis.

This article provides a comprehensive macroeconomic analysis, comparing South Korea and India. It begins with a historical overview of both economies, noting South Korea's rapid industrialization post-Korean War in the year 1953 and India's economic trajectory post-independence in the year 1947. We further delve into socio-economic trends like population, literacy, and unemployment rates, alongside ease of doing business indicators.

A significant focus is on the electronics industry, particularly semiconductors, as a major export sector for South Korea. The study uses various macroeconomic indicators like GDP, inflation, unemployment rate, exchange rate, interest rates, and FDI inflows to analyze economic trends over five years from 2017-2021, particularly emphasizing South Korea's global semiconductor market share.

The article also examines the impact of major global events like the COVID-19 pandemic and the Russia-Ukraine War on these economies. It discusses how these events affected indicators like GDP growth rate, inflation, federal bank repo rate, current account to GDP ratio, and exchange rate changes. The analysis provides insights into how these economies navigated the challenges posed by these events, highlighting differences in their economic resilience and policy responses.

Historical Overview

Following the independence of both India and South Korea in 1947 and 1948 respectively, both countries were primarily agricultural economies.

South Korea: Post-1948, South Korea transitioned from an agriculture-based economy to an industrial powerhouse. The government's role in fostering conglomerates like Samsung and Hyundai, combined with financial liberalization policies, catapulted South Korea onto the global stage.

South Korea witnessed rapid industrialization in the 1960s. The government gave priority to economic development through a combination of state planning and private entrepreneurship. Conglomerates like Samsung, SK Group, Hyundai, Lotte, etc took off, generously supported by the government, and have since played an important role in making South Korea a major player on the global stage.

South Korea embarked on a deregulation journey in the early 1980s and introduced the "Financial Liberalization Plan", which aimed to deregulate the financial sector and open up the market to foreign competition. The country also liberalized its FDI and FII system and even permitted foreign investment in Korean stocks.

This enabled it to adopt rapid technological advancements and it continues to be an advanced manufacturing base. It topped the Bloomberg Innovation Index in 2021 (and five out of six years before that).

India: Since independence in 1947, India's journey was initially marked by modest growth. Despite the focus on modern industries, scientific and technological institutes, and the development of space and nuclear programs, India’s economic growth between the 1950s to 1970s was muted.

In the 1980s, although there was an increase in the growth rates, capital inflows continued to be restricted to aid, commercial borrowings, and remittances from Non-Resident Indians.

India’s high reliance on oil imports, coupled with internal structural problems, including an inefficient industrial sector, heavy regulation, and a growing fiscal deficit led to the 1991 economic crisis. The 1991 economic crisis spurred landmark liberalization reforms, pivoting India towards a more open and competitive economy.

In response to the crisis, the LPG – Liberalisation, Privatisation, and Globalisation reforms were introduced. It included easing Foreign Direct Investments (FDI) and Foreign Institutional Investments (FII) restrictions, encouraging participation of private sector participants, and deregulating the financial sector. India's economy has soared since then, propelling it to its current status as the fifth-largest economy globally.

Socio-Economic Trends

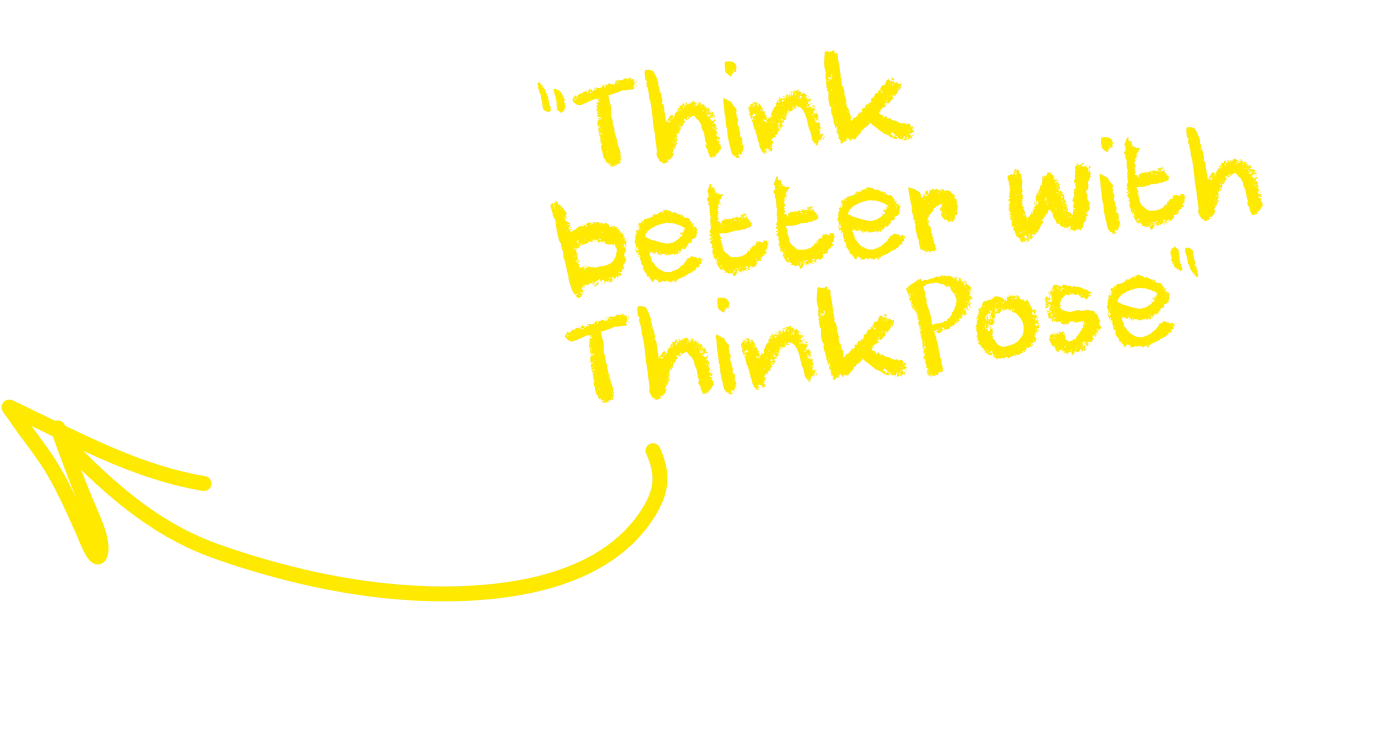

A comparison of demographic and social indicators reveals diverging paths:

- South Korea boasts a high literacy rate and low unemployment, reflective of its developed economic status.

- India's larger population and lower literacy rate indicate both challenges and potential for growth.

Source: Statista

Ease of Doing Business

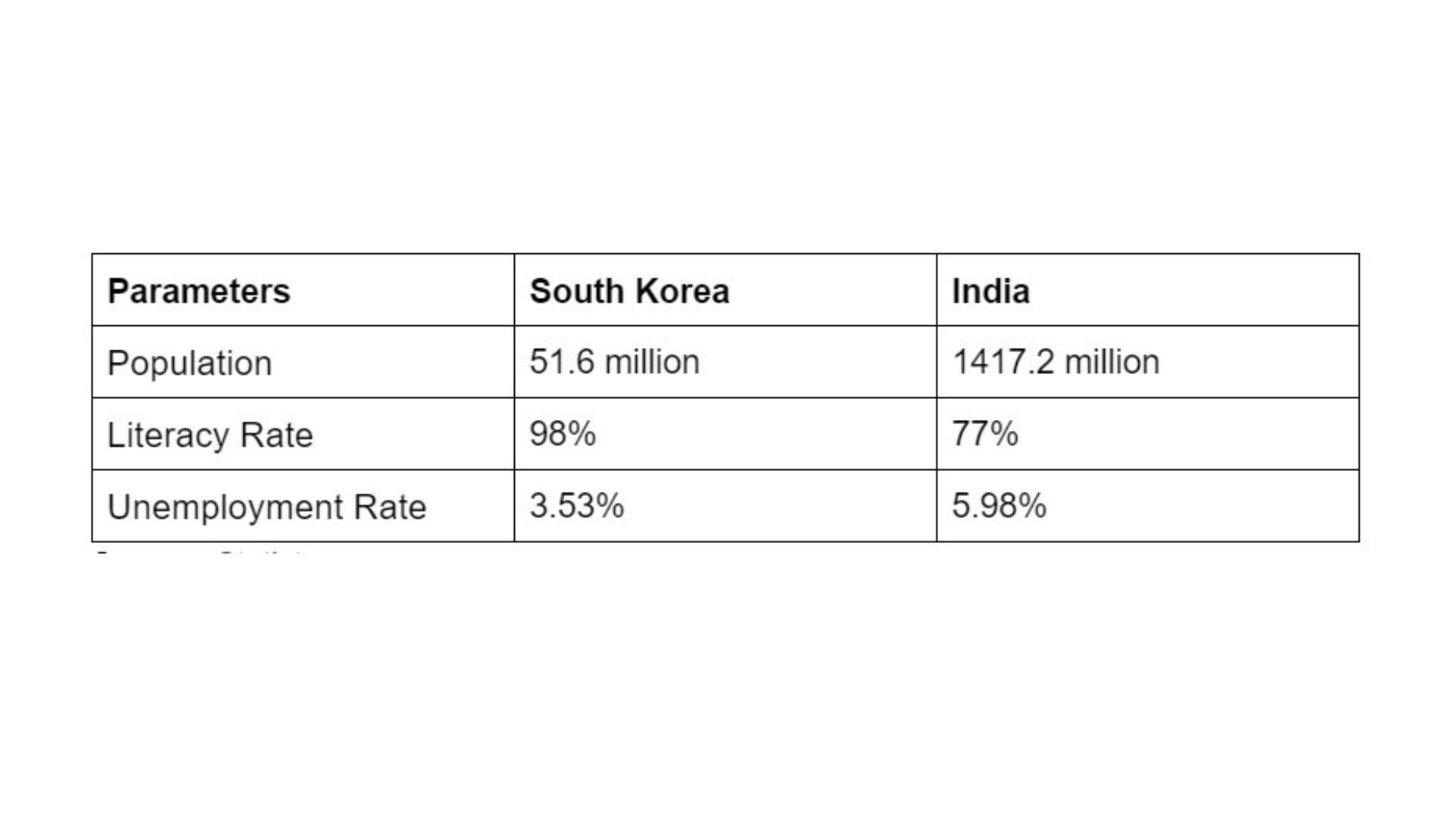

Ease of doing business policies can have a positive impact on a country's GDP by attracting foreign investments, promoting entrepreneurship, and increasing productivity. Although numerous factors can affect economic growth, the ease of doing business ranking is a crucial indicator that has been shown to have a beneficial effect on inbound FDI and FII.

Policies impacting the ease of doing business are crucial for economic health. South Korea's high ranking reflects its conducive environment for entrepreneurship and foreign investment. India, though lower-ranked, has made significant strides in improving its business climate over the last decade.

Source: Mazars

South Korea’s Electronics Industry: A Spotlight

South Korea's electronics industry, especially semiconductors, is a global leader. The study of this sector through various macroeconomic indicators offers insights into the country's economic prowess.

According to WITS data of 2020 (Ref. 1), the major exports from South Korea are Machinery and Electronics, which together constitute 30.83% of the total export product share. The area of study chosen is the Electronics Industry as it contributes to 21.6% of the total exports. Samsung Electronics leads the pack of companies in the Fortune 500 list of 2020 with a revenue of 197.71 billion USD from South Korea.

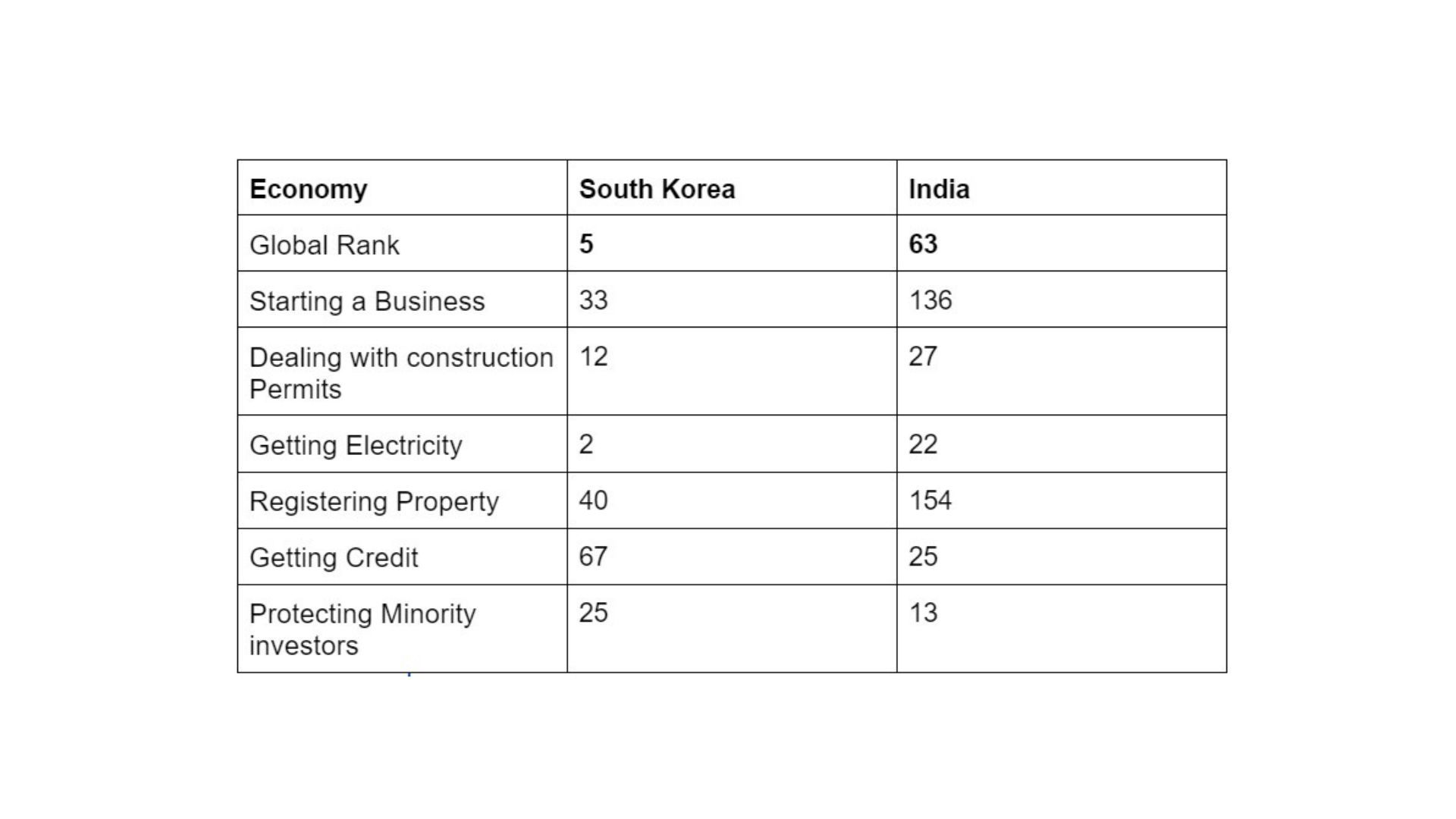

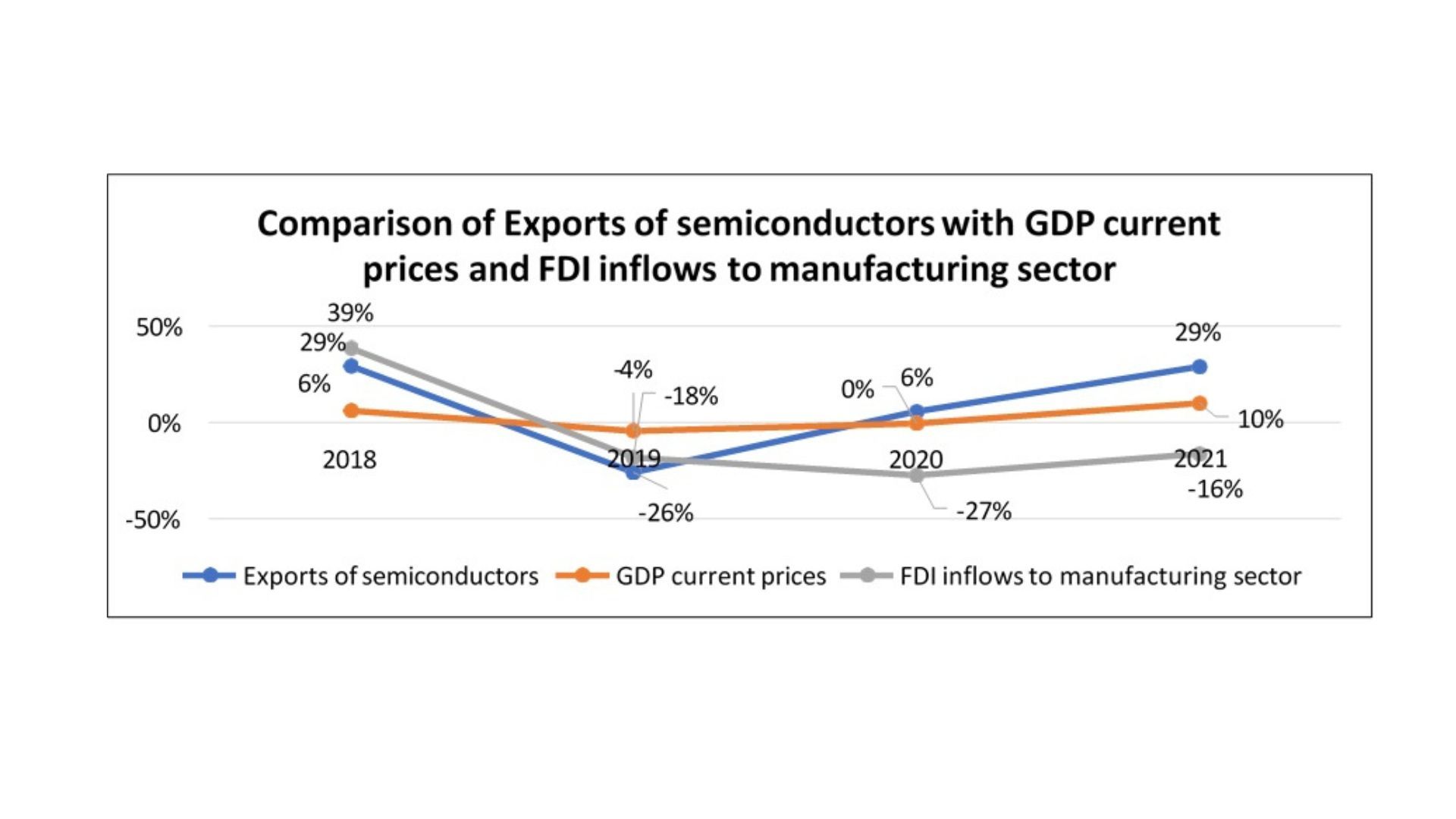

To analyze this industry in depth, the below macroeconomic indicators have been studied and compared across 5 years based on the exports of semiconductors from South Korea as it contributes to 18.4% of the global market share of semiconductors.

Macroeconomic Indicators Analysis

An Analysis of GDP, inflation rate, unemployment rate, annual exchange rate, interest rates, and FDI inflows of a nation's economic health, indicating not only its current fiscal stability but also its potential for future growth and investment attractiveness.

Further, the impact of these indicators on the electronics industry, with a focus on semiconductors, is significant as they influence production costs, consumer demand, investment trends, and global supply chain dynamics, all of which are crucial for growth and innovation in this high-tech sector.

South Korea's advanced manufacturing capabilities have fueled steady GDP growth and moderate inflation. India's growth, though uneven, shows promise given its large market size.

South Korea's stable job market contrasts with India's higher unemployment rates. Currency fluctuations in both countries reflect global economic dynamics.

South Korea:

Source: Statista

Source: Statista

From the above graph, it is evident that with a decrease in FDI inflows to the manufacturing industry the exports of semiconductors fell, this is due to the slowdown of expansion and production capabilities.

However, in the latter half of 2019, there was an increase in the FDI inflows that resulted in technological expansion and boosted the semiconductor industry's growth along with high competitiveness. The demand for Semiconductors improved during the pandemic as the global economy in 2021 moved towards more technological products which is depicted in the graph.

Global Events and Economic Impact

Disruptions in supply chains and economic activities have become universal since the global pandemic, but the resilience and policy responses varied. South Korea's robust healthcare system and India's large-scale stimulus measures are noteworthy.

Further, the Russia-Ukraine war's ripple effects, particularly in oil prices and electronics demand, impacted both economies differently, underlining the interconnectedness of global markets.

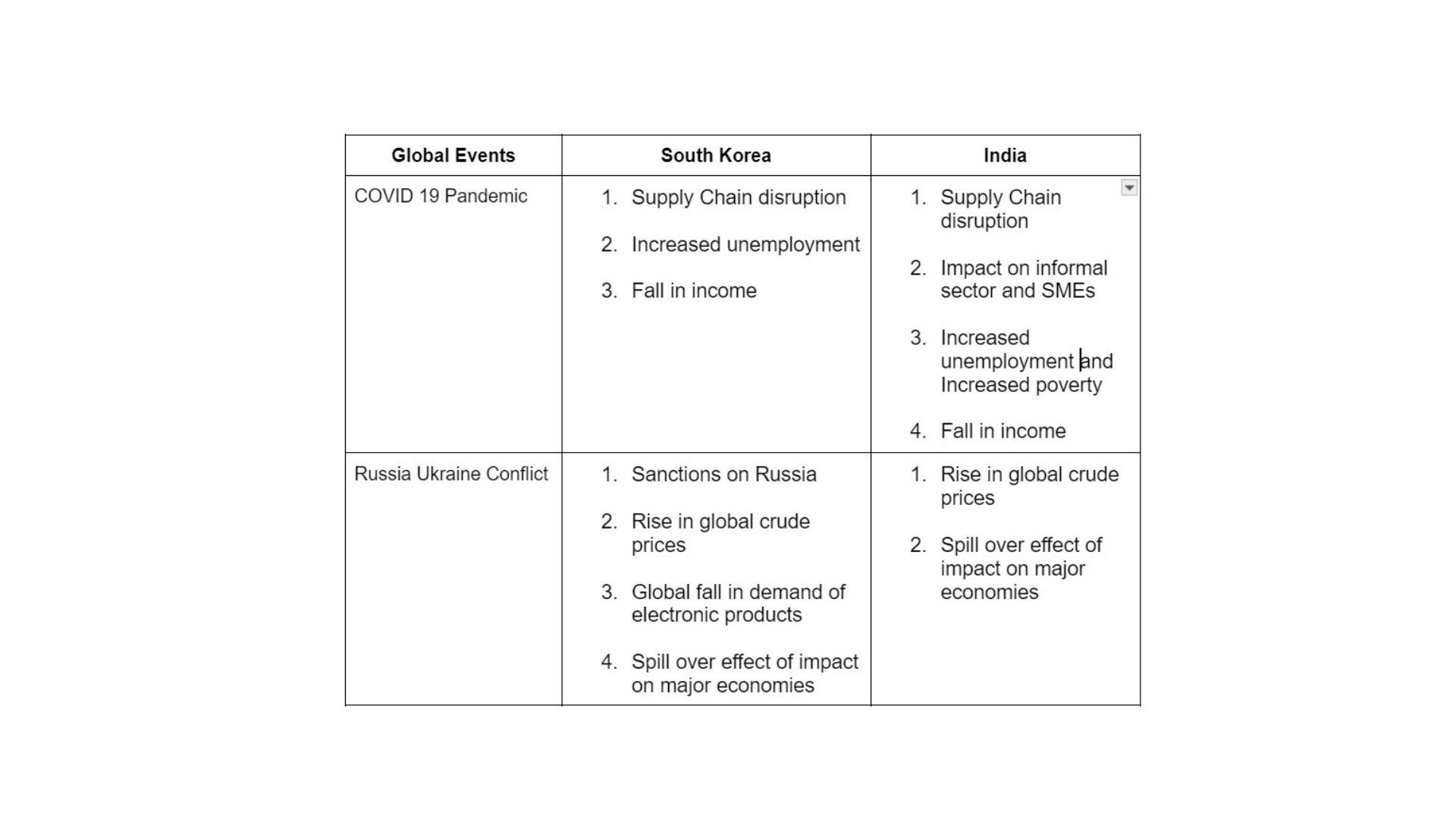

Both Indian and South Korean markets have responded to the global slowdown during COVID-19 and the Russia-Ukraine conflict differently. COVID-19 affected India more than South Korea, on the other side, the Russia-Ukraine War impacted South Korea more than India due to several economic and non-economic factors. Some of the major reasons that impacted economic indicators during the two world events are given below.

Comparative Analysis of Economic Indicators:

Analysis of GDP growth rates, inflation, repo rates, and current account ratios highlights the distinct economic strategies and outcomes of these two Asian powerhouses.

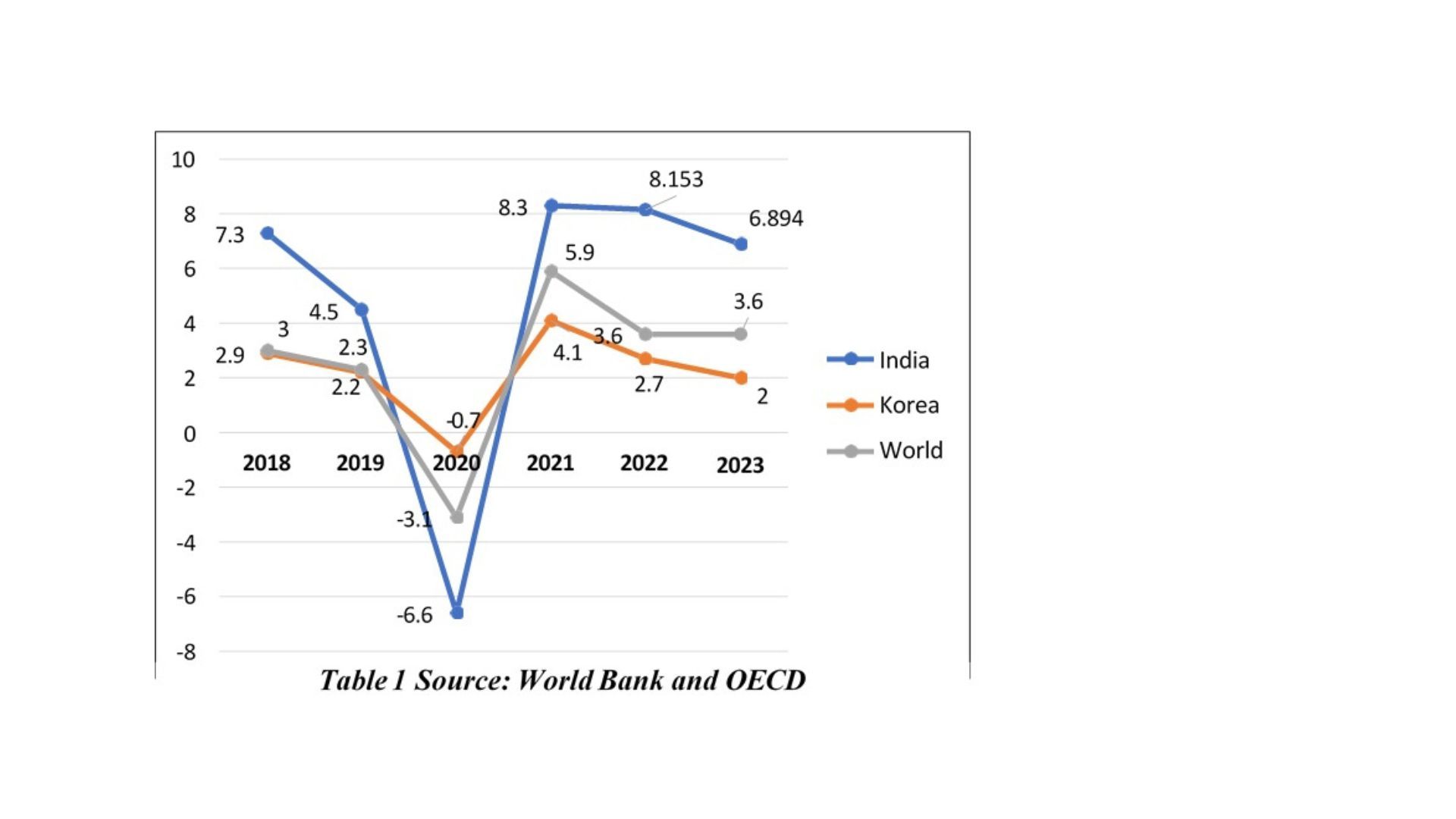

Real GDP Growth Rate:

Source: OECD

It can be seen from the below graph that in 2020, due to COVID-19, India’s GDP growth contracted by 6.6% and South Korea’s GDP by 0.7%. From 2021 onwards, India and Korea started to recover from the economic stress.

From February 2022 onwards, due to the Russia-Ukraine war, South Korea’s growth rate started to slow down as the demand for electronic products stopped due to global inflation. On the other hand, the Indian economy did not get significantly impacted.

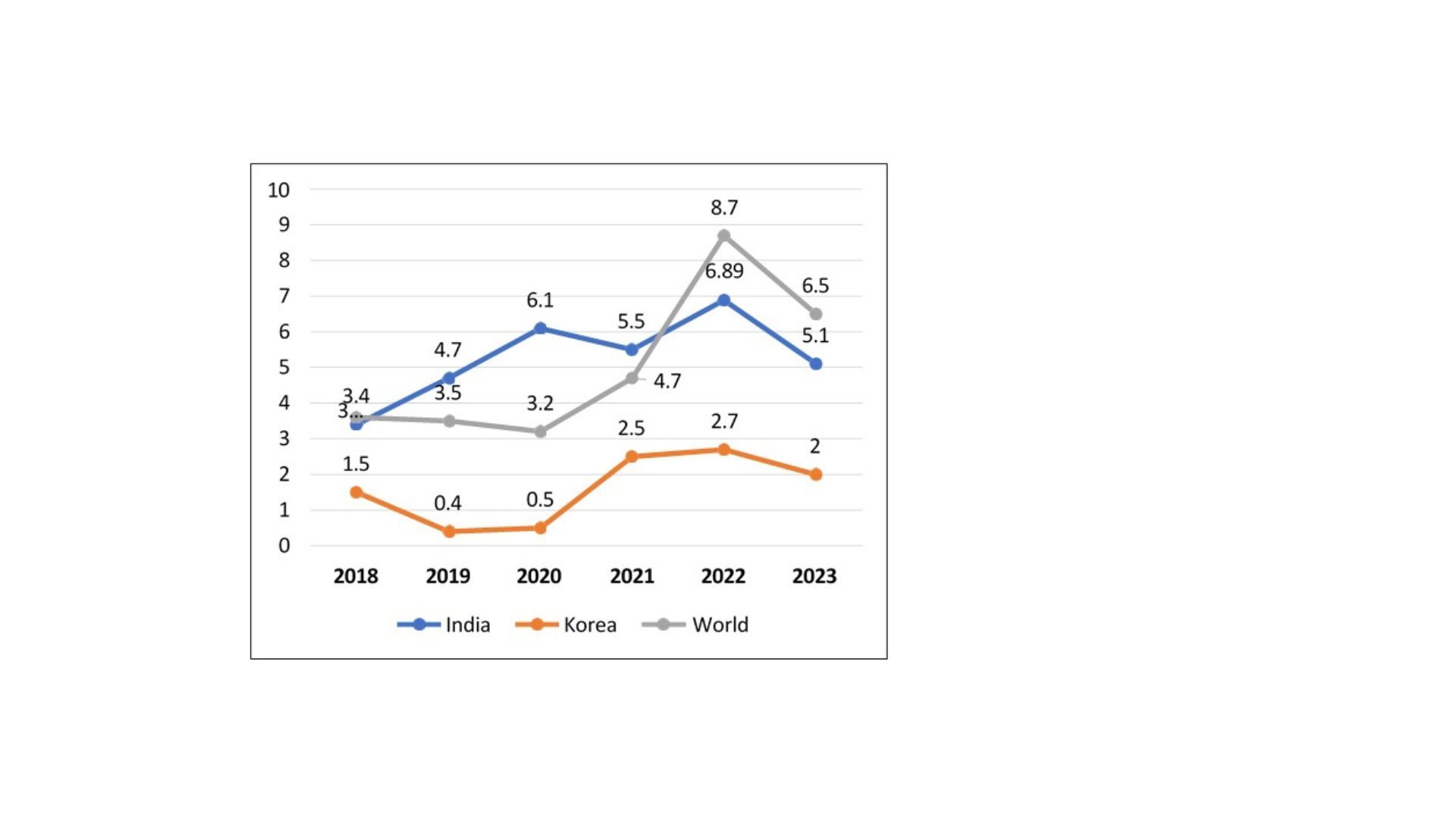

Inflation:

Source: IMF

In 2020, Korea started to recover due to the country's comprehensive crisis management system. On the other hand, India’s inflation jumped to 6.1% due to the rise in food prices and the disruption of the supply chain.

Due to the Russia-Ukraine war, both India and South Korea’s inflation surged primarily due to crude oil price rises and demand-supply imbalances. South Korea also accepted sanctions on Russia which further aggravated the situation.

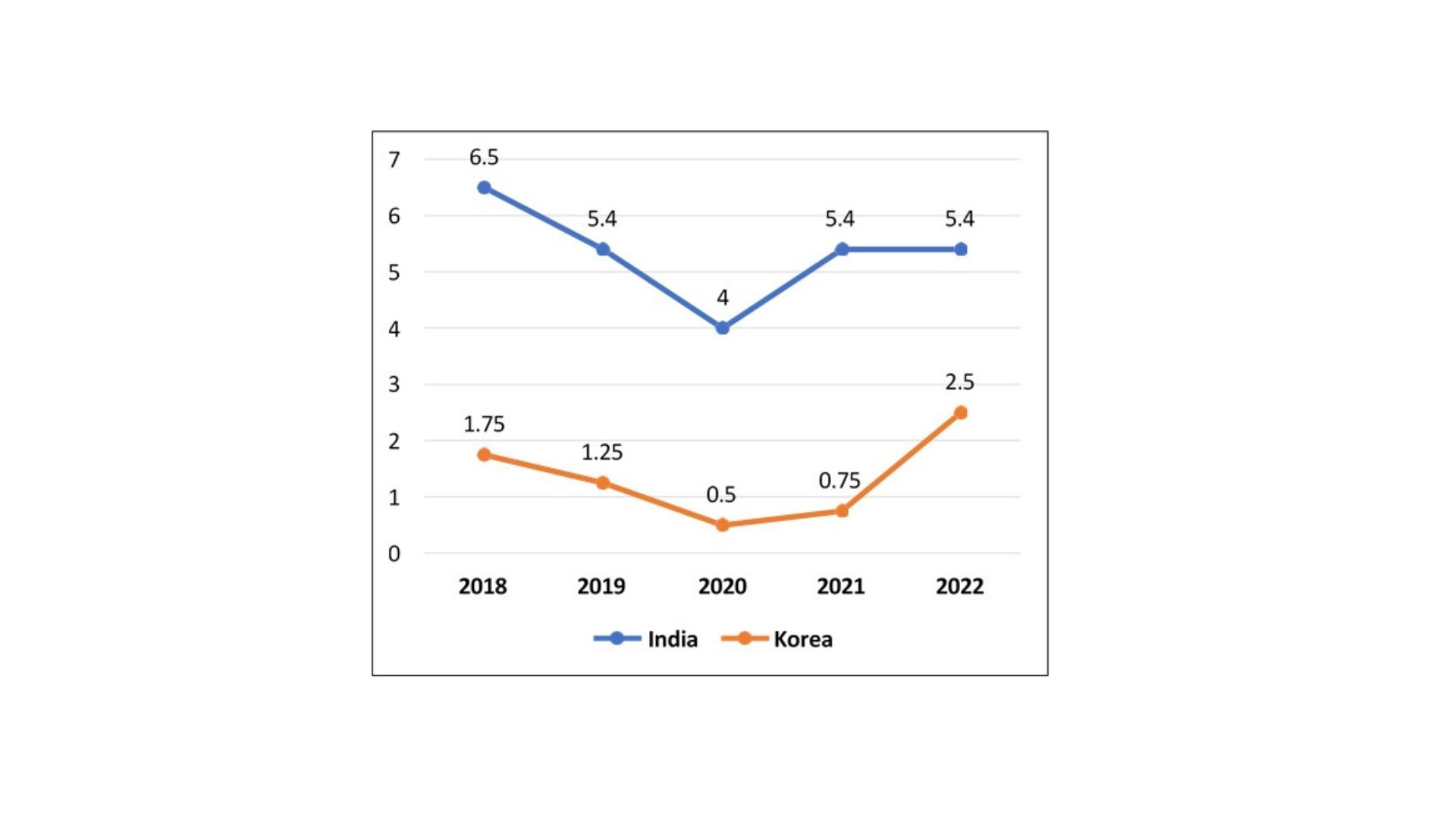

Federal Bank Repo Rates

Source: CentralBankRates

In 2020 the Reserve Bank of India (RBI) (the Central Bank of India) cut down the Repo rate to encourage banks to deploy excess funds towards lending and boost the economy of the country. Bank of Korea (the Central Bank of South Korea) also brought down its repo rate to 0.5% to funnel cash into money markets.

In 2022, the Bank of Korea hiked the base interest rate to 2.5% citing upward inflation. RBI on the other hand continued with a 5.4% interest rate to boost its economy.

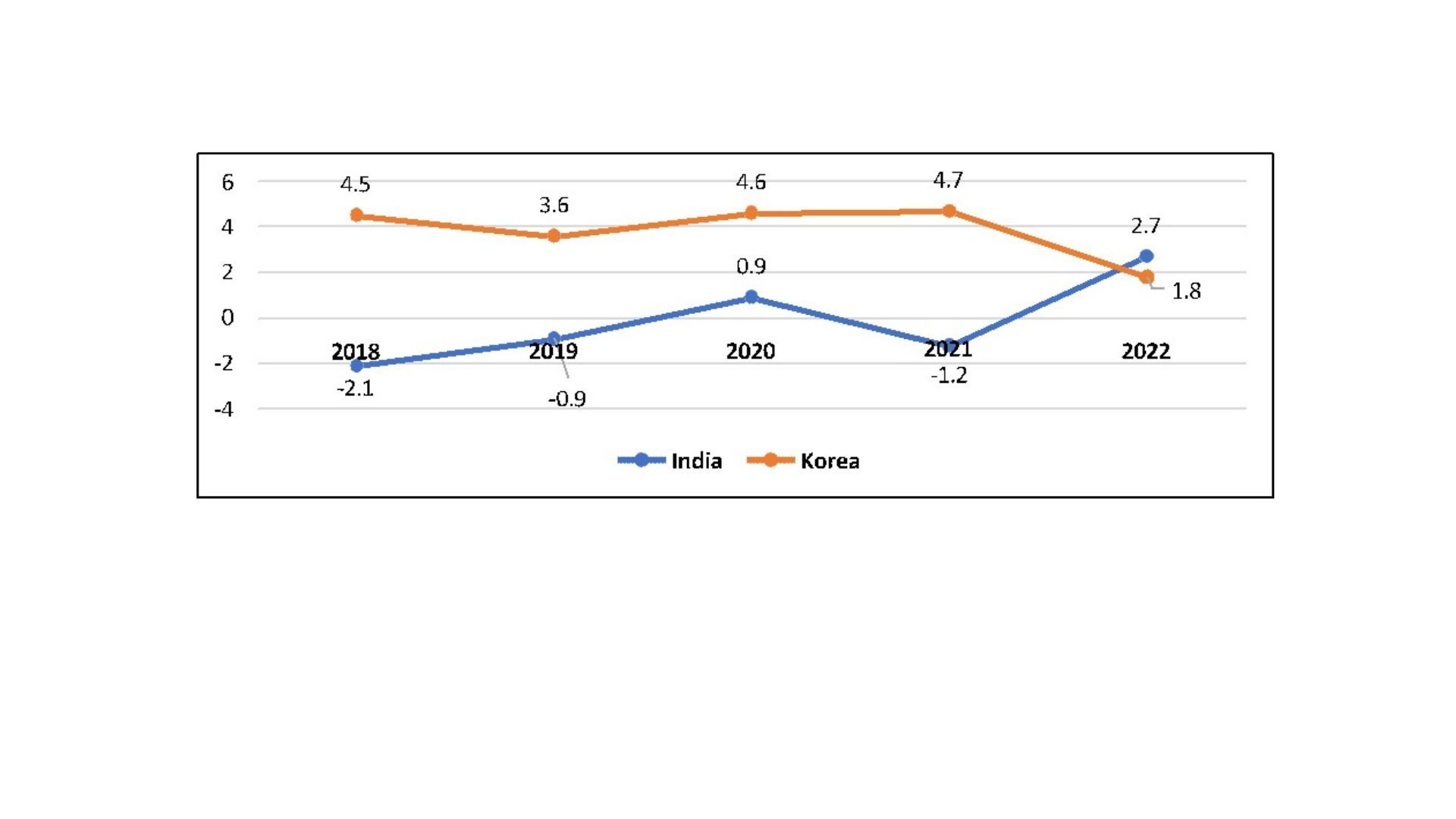

Current Account to GDP

Source: TradingEconomics

In 2020, Korea managed to maintain its ratio due to its soaring exports. Korea has been in surplus since 1980. India managed to be in surplus for a few quarters due to weak domestic demand and very low imports, which was not a healthy indicator.

The Russia-Ukraine war has impacted Korea badly due to global inflation. Its exports have dropped and the ratio is at 1.8. India on the other hand has improved its exports and imports figures during a turbulent global economy.

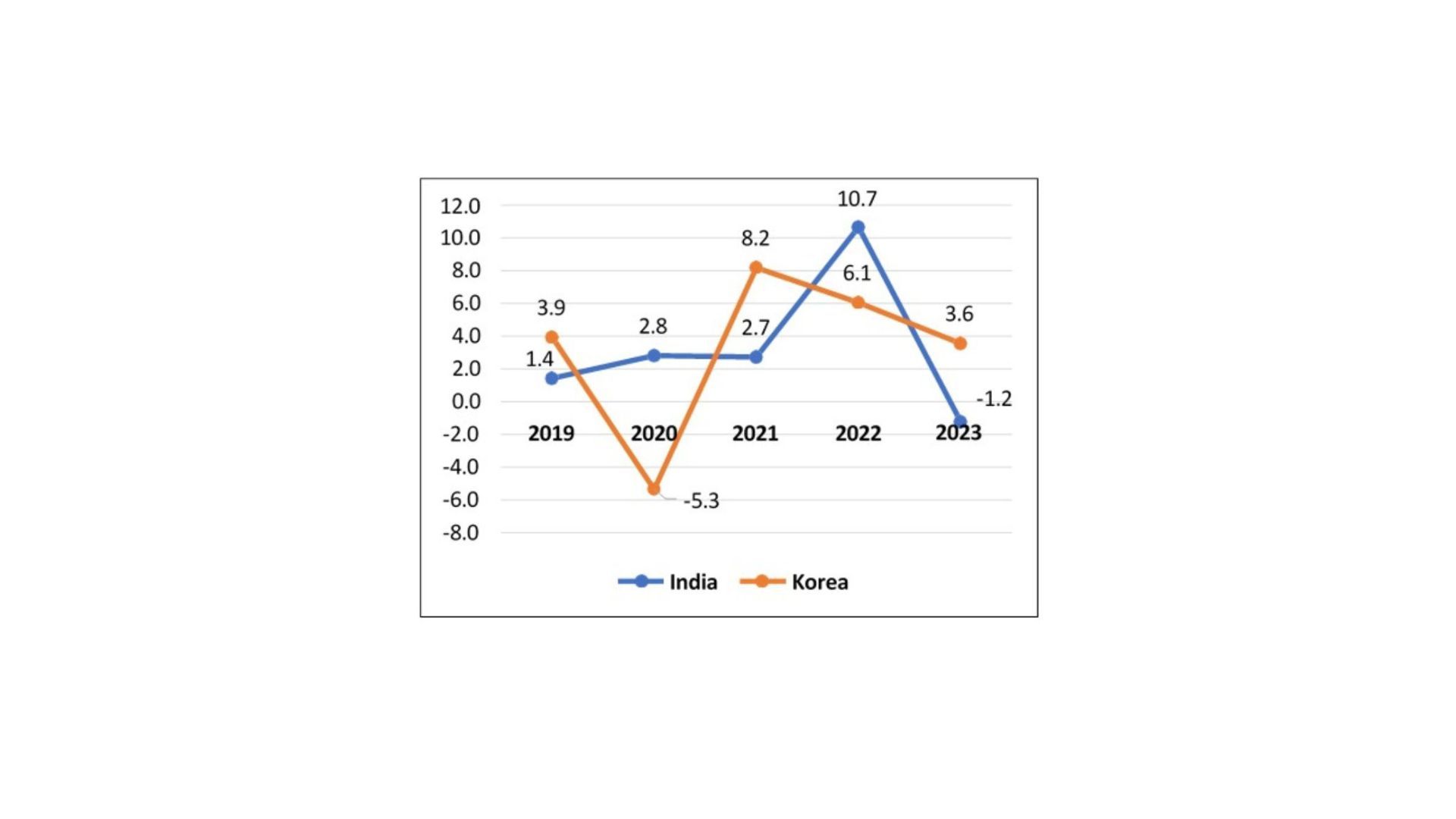

Exchange Rate (% change against USD, year-end)

Source: Forbes

In 2020, the South Korean currency appreciated by 5.3%, and the Indian currency depreciated by 2.8%. Korean currency improved due to optimism over vaccines for COVID-19 and additional fiscal package stimulus in the United States. Indian currency on the other hand depreciated because of the COVID-19 pandemic consequences.

In 2022, India witnessed a massive surge of around 10.7% due to disrupted global supply chains, fuelling inflation as well as inflationary expectations across the world. Korean currency also faced similar challenges but not to the extent felt by India.

Conclusion

The economic narratives of South Korea and India, while distinct, are united in their resilience and adaptability. As they navigate the changing global economic landscape, their strategies and responses offer valuable lessons and insights into the dynamics of emerging and developed economies alike. Here are some of the key takeaways for businesses from the above macroeconomic study of South Korean and Indian economies:

- Embrace Technological Innovation: South Korea's success in the electronics sector, especially semiconductors, highlights the importance of investing in technological innovation and R&D for businesses.

- Diversification is Key: India's diverse economy, spanning traditional industries and modern services, underscores the importance of diversification in business models to mitigate risks and tap into new markets.

- Adaptability to Economic Policies: Both countries have shown varying degrees of openness to foreign investment and ease of doing business. Companies should be adaptable to policy changes and leverage them for growth and expansion.

- Leverage Demographic Advantages: India's large and young population offers a vast consumer market and labor force, while South Korea's educated workforce is a boon for skill-intensive industries.

- Resilience in Global Crises: The response to global events like the COVID-19 pandemic illustrates the need for businesses to be resilient and adaptable in the face of unforeseen challenges.

- Global Supply Chain Integration: South Korea's integration into global supply chains, particularly in electronics, is a model for businesses aiming for global competitiveness.

- Focus on Sustainable Growth: Both countries' focus on sustainable economic policies suggests that businesses should align with environmental and social governance (ESG) criteria to ensure long-term viability.

- Leveraging Government Support: Both economies have benefitted from government support in different sectors. Businesses should be proactive in leveraging such support, including subsidies, tax incentives, Product Linked Incentive Schemes (PLI), and policy reforms.

- Understanding Market Dynamics: India's growth trajectory and South Korea's established economic stability offer different market dynamics. Businesses should tailor their strategies to align with these unique environments.

- Risk Management: The varied economic challenges faced by both countries highlight the importance of robust risk management practices in business operations.